华虹半导体有限公司华虹半导体有限公司(在香港注册成立的有限责任公司)(股票代码:1347)截至2022年12月31日年度业绩

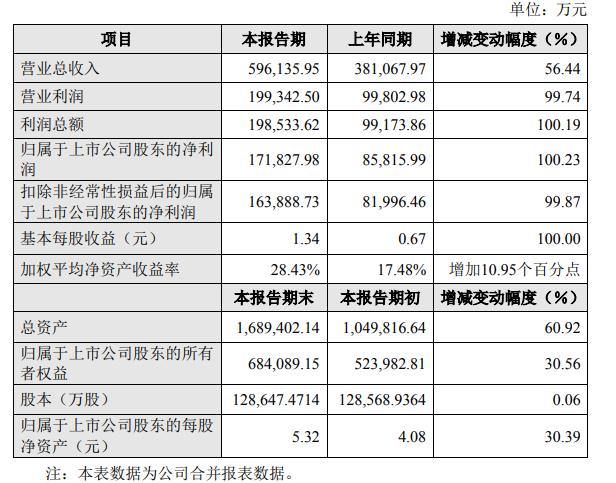

财务亮点

华虹半导体有限公司(“公司”或“华虹半导体”,连同其子公司,“集团”)董事会(“董事会”)很高兴宣布公司截至2022年12月31日止年度的合并业绩。

与2021数据相比,重点是:

收入为247550万美元,创历史新高,比上年增长51.8%。

毛利率为34.1%,与2021的27.7%相比增加了6.4个百分点,主要原因是平均售价和产品组合有所改善,部分被折旧成本增加所抵消。

净利润为4.066亿美元,比2021增长76.0%。

本年度归属于母公司所有者的利润为4.499亿美元,比2021增长72.1%。

基本每股收益为0.345美元,比2021增长71.6%。

股本回报率为15.2%,比2021高5.5个百分点。

经营活动产生的净现金流量为7.509亿美元,比2021增长44.8%。

产能达到每月32.4万片8英寸等效晶圆,而同期为31.3万片。

晶圆出货量(8英寸等效晶圆)为4087000片,而同期为3328000片。

为了更好地服务市场需求,提高公司在晶圆代工行业的市场地位和核心竞争力,应对不断变化的市场环境,公司对股东保持稳定、谨慎和负责任的政策。根据可持续经营和长期发展的原则,董事会不建议支付截至2022年12月31日的年度股息(2021:无)。公司将保留足够的现金来继续其投资活动,以使股东利益最大化。

致股东的信函

尊敬的股东们:,

2022年是非同寻常、充满挑战的一年,几乎所有世界经济体都受到了百年一遇疫情持续死灰复燃、全球产业供应链重塑和地缘政治挑战的影响。半导体行业也进入了调整期。尽管宏观环境存在诸多不确定性,但华虹半导体在2022年继续开拓进取,并取得了持续改善,其增长在行业中处于领先地位。凭借“8英寸+12英寸”战略的优势,公司致力于专业工艺技术的持续创新,并利用我们的专业工艺平台,包括嵌入式/独立非易失性存储器、电源设备和模拟与PM,发展了产品的核心竞争力。我们坚持先进的“专业集成电路+功率分立”双管齐下战略,迅速渗透下游新兴市场,拓展汽车、新能源、物联网、数据中心等市场,不断为全球客户提供卓越的晶圆代工服务和解决方案。

报告期内,公司收入创下247550万美元的历史新高,比上年增长51.8%,来自美国、欧洲、日本和中国的地区收入大幅增长。2022年,我们的细分市场需求强劲。公司汽车电子产品年收入同比增长超过100%,新产品引进数量持续增加。同时,公司在新能源市场稳步发展,在支持全球风电/光电/储能领域的产业链方面发挥了重要作用。多元化的工艺平台、丰富的国内外客户资源以及前瞻性和专注性的产能安排,使华虹半导体在行业周期下行的情况下仍保持了行业领先的产能利用率。年内,公司整体毛利率达到34.1%,比上年提高6.4个百分点。本年度利润为4.066亿美元,较上年增长76.0%;净资产收益率为15.2%,比上年增长5.5个百分点。

截至2022年底,华虹半导体拥有三家8英寸晶圆厂和一家12英寸晶圆厂。最近三年,年产能(8英寸晶圆当量)每年从248.52万片增加到326.04万片,然后是386.27万片,复合年增长率为24.67%。现有的12英寸晶圆厂在2022年实现了高水平运营,月产能为6.5万片。该公司计划在2023年将月产能提高到9.5万片,并将在适当时候开始建设一条新的12英寸生产线,继续提高其制造能力。

下文是华虹半导体2022年度业绩报告原文:

Hua Hong Semiconductor Annual Results 2022

HUA HONG SEMICONDUCTOR LIMITED华虹半导体有限公司(Incorporated in Hong Kong with limited liability)(Stock code: 1347)ANNUAL RESULTS ANNOUNCEMENTFOR THE YEAR ENDED 31 DECEMBER 2022

FINANCIAL HIGHLIGHTS

The Board of Directors (“the Board”) of Hua Hong Semiconductor Limited (“the Company” or “Hua Hong Semiconductor”, together with its subsidiaries, the “Group”) is pleased to announce the consolidated results of the Company for the year ended 31 December 2022.

Highlights in comparison with 2021 figures are:

Revenue was US$2,475.5 million, an all-time high and an increase of 51.8% over the prior year.

Gross margin was 34.1%, increased by 6.4 percentage points,compared to 27.7% in 2021,mainly due to improved average selling price and product mix, partially offset by increased depreciation costs.

Net profit was $406.6 million, 76.0% over 2021.

Profit for the year attributable to owners of the parent was US$449.9 million, 72.1% over 2021.

Basic earnings per share was US$0.345, 71.6% over 2021.

Return on equity was 15.2%, 5.5 percentage points over 2021.

Net cash flows generated from operating activities was US$750.9 million, 44.8% over 2021.

Capacity reached 324,000 8-inch equivalent wafers per month, compared to 313,000.

Wafer shipments (in 8-inch equivalent wafers) was 4,087,000, compared to 3,328,000.

In order to better serve market demand, enhance the Company’s market position and core competitiveness in the wafer foundry industry, and cope with the changing market environment, the Company is maintaining a stable, prudent, and responsible policy for our shareholders. Based on the principles for a sustainable operation and long-term development, the Board did not recommend the payment of any dividend for the year ended 31 December 2022 (2021: nil). The Company will retain sufficient cash to continue its investment activities, in order to maximize benefits for our shareholders.

LETTER TO SHAREHOLDERS

Dear Shareholders,

In 2022, an extraordinary and challenging year, almost all the world’s economies were affected by the continuous resurgence of the once-in-a-century pandemic, reshaping of the global industry supply chain, and geopolitical challenges. The semiconductor industry also entered a period of adjustment. Despite many uncertainties in the macro environment, Hua Hong Semiconductor continued to forge ahead and made continuous improvement in 2022, with its growth leading the industry. With the advantages of our “8-inch + 12-inch” strategy, the Company stayed committed to continuous innovation of specialized process technologies and developed core competitiveness of products using our specialized process platforms, including embedded/standalone non-volatile memory, power device, and analog & PM. We persisted in our advanced “Specialty IC + Power Discrete” dual-pronged strategy, rapidly penetrated downstream emerging markets, expanded our markets in automobiles, new energy, Internet of Things, data centers, etc., continuously providing excellent wafer foundry services andsolutions for our global customers.

During the reporting period, the Company’s revenue hit a record high of US$2,475.5 million, representing an increase of 51.8% compared to the previous year, and regional revenues from the United States, Europe, Japan, and China increased significantly. In 2022, we experienced strong demand in our market segments. The Company achieved a year-on-year increase of more than 100% in annual revenue from automotive electronics and a continual increase in the number of new products introduced. Meanwhile, the Company made steady progress in the new energy market and played a significant role in supporting the global industry chain in the wind power/photoelectricity/energy storage field. Diversified process platforms, abundant customer resources at home and abroad, and a forward-looking and dedicated capacity arrangement enabled Hua Hong Semiconductor to maintain leading capacity utilization rate in the industry, despite the downward cycle of the industry. In the year, the overall gross profit margin of the Company reached 34.1%, representing an increase of 6.4 percentage points compared to the previous year. Profit for the year was US$406.6 million, representing an increase of 76.0% compared to the previous year; ROE was 15.2%, representing an increase of 5.5 percentage points compared to the previous year.

As at the end of 2022, Hua Hong Semiconductor had three 8-inch fabs and one 12-inch fab. For the most recent three years, annual production capacity (8-inch wafer equivalent) increased each year from 2.4852 million to 3.2604 million and then 3.8627 million, with a CAGR of 24.67%. The existing 12-inch fab was operated at a high level with a monthly production capacity of 65,000 wafers in 2022. The Company plans to increase its monthly production capacity to 95,000 wafers in 2023 and will start construction of a new 12-inch production line in due course, continuing to improve its manufacturing capacity and technological upgrading.

As a key part of the global semiconductor industry supply chain, the Company has markets covering the whole industry, with its strong industry presence. With robust strength in semiconductor manufacturing in China, the Company won the “20-year Special Contribution Award in China Semiconductor in 2022 China IC Design Achievement Award.” As a well-known enterprise in Shanghai, the Company worked judiciously in cities to promote regional economic development in the Yangtze River Delta. Its contribution was recognized by all corners of society. In the year, it won the “Outstanding Contribution Award for Scientific and Technological Innovation in Pudong New Area” again.

Only with diligent employees will we be able to achieve success in the face of more complicated and fierce competition. We will continue to strengthen our advantages in various specialized technologies, constantlyoptimize product structure in close alignment with market trends, and accumulate new momentum for high-quality development. New opportunities will be identified from challenges and new prospects will be opened up in a changing environment. Hua Hong Semiconductor will unswervingly innovate with international vision to create new products for our customers all over the world and make achievements by establishing development projects in new areas of technology. We sincerely thank all our employees, shareholders, customers, and friends from all walks of life for their support for and cooperation with Hua Hong Semiconductor. Let’s work together to achieve another year of splendid results.

Mr. Suxin Zhang

Chairman and Executive Director

Mr. Junjun Tang

President and Executive Director

Shanghai, PRC

30 March 2023

About the Company

Hua Hong Semiconductor Limited (“Hua Hong Semiconductor”, stock code: 1347.HK) (the “Company”) is a global, leading pure-play foundry focused on continuous innovation of “8-inch + 12-inch” specialty technologies, including non-volatile memory (“NVM”), power discrete, analog & power management, and logic & RF, supporting applications in emerging areas, such as the Internet of Things, using advanced “Specialty IC + Power Discrete” technology platforms. Of special note is the Company’s outstanding quality control system that satisfies the strict requirements of automotive chip manufacturing. The Company is part of the Huahong Group, an enterprise group whose main business is IC manufacturing, with advanced “8-inch + 12-inch” production line technology.

The Company presently operates three 8-inch wafer fabrication facilities (HH Fab1, HH Fab2, and HH Fab3) in Jinqiao and Zhangjiang, Shanghai, with a total monthly 8-inch wafer capacity of approximately 180,000 wafers. The 12-inch wafer fabrication facility (HH Fab7) in Wuxi National High-Tech Industrial Development Zone, at a 65,000 wafer per month capacity, has become a leading 12-inch foundry devoted to power discrete semiconductors in the Chinese mainland.

-

集成电路

+关注

关注

5218文章

9466浏览量

347475 -

晶圆

+关注

关注

50文章

3869浏览量

125467 -

华虹半导体

+关注

关注

3文章

86浏览量

37376 -

华虹宏力

+关注

关注

0文章

12浏览量

4636

发布评论请先 登录

相关推荐

世健喜获首尔半导体2013年度代理商最佳业绩奖

大硅片助力,使上海新阳公司盈利比上年同期增长25%到37.87%

华虹半导体发布2018年第三季度业绩情况 销售收入再创新高正全速推进无锡工厂建设

顺络电子电感产品业务平稳增长 销售及利润情况创历史新高

华虹半导体2019年实现营收9.33亿美元 12英寸产线扩产提速

华虹无锡12寸厂销售收入再创历史新高

晶盛机电围绕先进材料先进装备战略 2021年度业绩翻倍

华虹半导体研报 收入创历史新高较上年度增长69.6%

2021年全球半导体设备销售创下历史新高

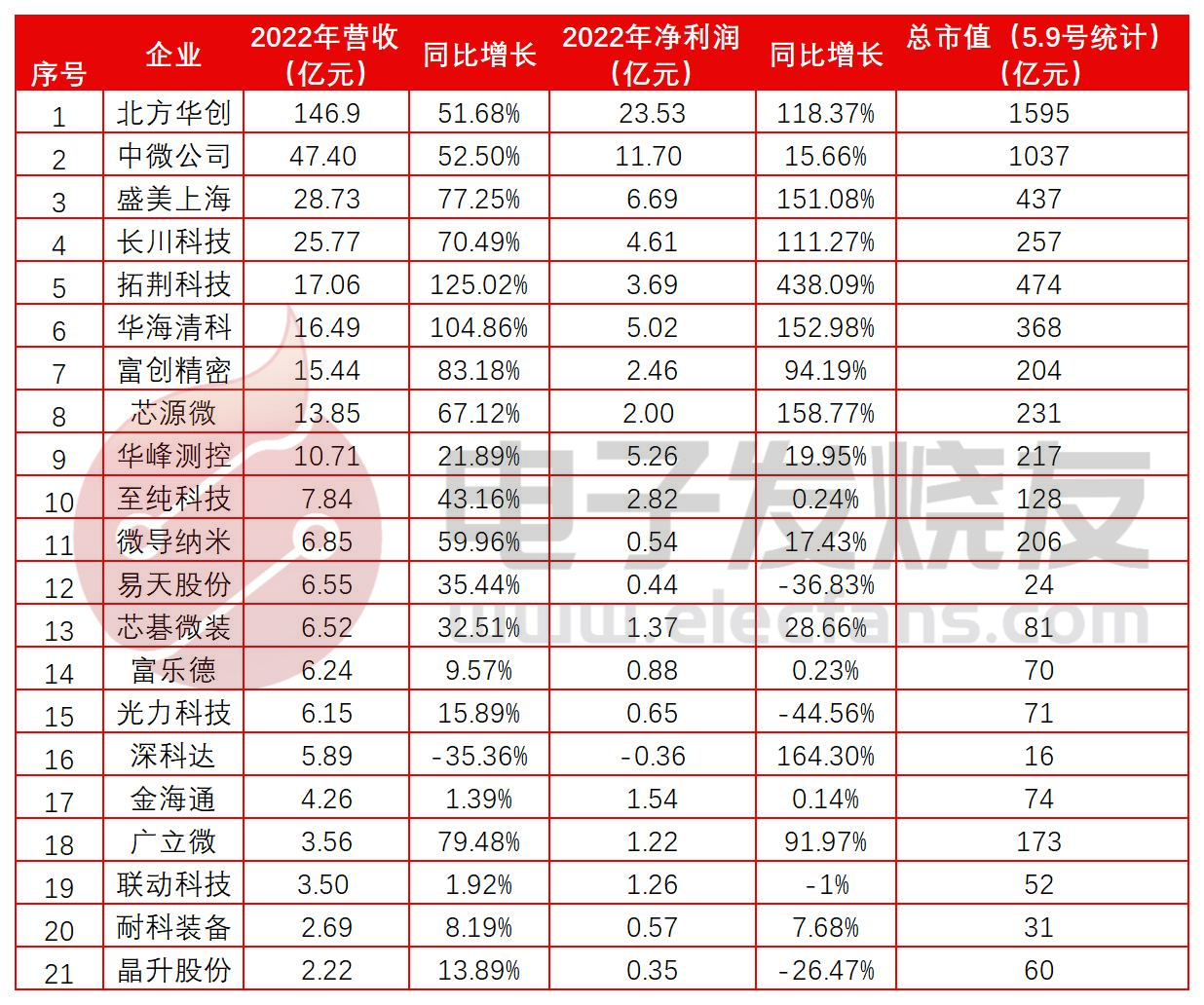

21家半导体设备上市公司2022年度业绩复盘

国产晶圆代工厂华虹半导体登录科创板今日申购

华虹半导体怎么样?华虹半导体今日正式登陆科创板 今年最大募资规模IPO

华虹半导体2022年度业绩创历史新高 比上年增长51.8%

华虹半导体2022年度业绩创历史新高 比上年增长51.8%

评论